FINANZAS Y AÑO 2020. SE AVECINAN CAMBIOS

|

Este mensaje fue actualizado el .

Pues parece que 2020 va a ser un año de cambios. No quiere decir que venga el apocalipsis. Pero cambios tendremos, pues es evidente que son necesarios. ¿Seran acertados? No se sabe. Pero si que parece que van a ser al menos en parte revolucionarios.

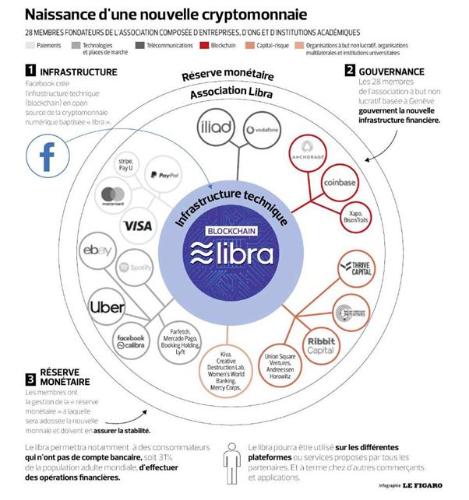

La deuda cada vez es mas insostenible. El mercado de repos (interbancario nocturno) norteamericano no se sostiene mas que con diaria respiracion asistida. Ya llevamos 430 mil millones de dolares en esto. Naturalmente no hay solo un problema norteamericano. La rebelion contra los excesos de deuda central emitida se extiende entre los paises de la zona euro, los fiscalmente mas saneados, se entiende. Lagarde no esta ya de banquera central por casualidad. Que no sea una economista la que comande el pilotajer de la nave europea los años por venir tampoco es una casualidad. No me voy a extender. Hago un copiar y pegar de un informe donde se detallan unas caracteristicas concretas del mundo que viene. La criptomoneda Libra parece (parece) ser el "caballo de troya" alrededor del cual girara en "Occidente" la nueva arquitectura financiera. Yo no estoy muy seguro de eso. Pero la arquitectura mostrada en el grafico parece bastante detallada. Del "otro lado" (notese las comillas) nos encontramos con la apuesta mas segura en ser implementada: el e-yuan o moneda china electronica. No añado mas. El articulo es de lo mas explicito. Espero que el copiar y pegar del grafico explicativo de Libra me quede bastante potable. Geopolítica monetaria: libra contra el yuan electrónico El inmenso estancamiento de una zona euro atrapada en una UE en deterioro ha hecho que muchas personas se pierdan el euro. Pero dos puntos de inflexión sacuden la unión monetaria de su letargo. Es una cuestión de: El anuncio de Facebook del lanzamiento de su moneda virtual, libra, que ha creado pánico entre los estados y ha llevado hasta ahora a una especie de moratoria.[1] ; pero lo que Facebook ha declarado con este anuncio es que la economía electrónica mundial ya no puede estar satisfecha con el sistema monetario actual. . la llegada del yuan digital, o DC/EP [2], anunciada poco después del último agosto de la libra[3], un momento anunciado para el 11 de noviembre con motivo del Día de los Solteros [4], ahora previsto para enero-febrero: esta vez, ya no se trata de una moratoria, China es un Estado soberano que es libre de lanzar este tipo de iniciativas.  Mientras que la zona euro, el BPI y el Banco de Inglaterra están aterrorizados ante estos anuncios, el ex gobernador de la Reserva Federal Alan Greenspan cree que no hay razón para que los bancos centrales emitan monedas digitales[5]. Esta observación debe atribuirse a la edad del personaje, a su nacionalidad (es ante todo la hegemonía del dólar la que se ve amenazada por esta evolución); pero hay que hacer un tercer análisis de la resistencia muy lógica de un Greenspan a las monedas digitales del banco central: la libra es también el nuevo dólar, es decir, una moneda global emitida desde (en lugar de «por») los Estados Unidos. Por un lado, la FED mantendría su control sobre un dólar nacional que, como hemos analizado/anticipado repetidamente, está volviendo a casa; y por otro lado, las versiones modernas de la gobernanza global centrada en Estados Unidos, los GAFAs, están emitiendo una nueva moneda para el comercio internacional. La polarización de los modelos propuestos por la libra, por un lado, y el e-yuan, por otro, llevaría en su interior las semillas de una geopolítica monetaria con vocación ofensiva como evolución de la guerra comercial entre Estados Unidos y China. Observará las referencias simbólicas a una dialéctica de guerra fría entre el mundo libre (libra) y el bloque comunista (yuan en lugar de rublo esta vez). En su propia estructura, estas dos monedas se oponen: la libra es la llamada criptocurrencia descentralizada porque se basa en una tecnología de cadena de bloques adaptada a un modelo liberal[6] ; mientras que el e-yuan es una moneda digital regulada por el banco central chino en línea con un modelo económico socialista. Dicho esto, se está escribiendo mucho sobre la naturaleza centralizada del dinero del banco central digital que China está a punto de lanzar[7] ; pero Xi Jiping ha tomado a todos por mal camino al declarar muy recientemente todo lo bueno que pensaba de la cadena de bloques (descentralizada) como base para la gobernanza financiera internacional[8]. En realidad, China distingue entre las monedas nacionales centralizadas (o supranacionales, como el euro) y el sistema monetario internacional descentralizado que exige, y considera que cada nivel es indispensable y complementario del otro. En 2020, libra y e-yuan entran en los mercados: . para el yuan electrónico, es el mercado chino (1.500 millones de personas) extendido al mercado del PEER (2.100 millones, es decir, 600 millones de personas más, sin la India) cuya firma está previsto que finalice el próximo mes de febrero[9] y a los principales socios de la Ruta de la Seda (3.000 millones de personas afectadas, 900 millones más que el PECO)[10] como Asia Menor, Europa, África…. . por su parte, libra llega a sus 2.300 millones de usuarios – lo que explica por qué es Facebook y no Amazon (150 millones de cuentas de clientes «sólo») que lanza una moneda – centrada en Europa (286 millones de usuarios[11]), India (270 millones), Estados Unidos (190 millones) y países emergentes (Indonesia, Brasil, México, Filipinas, Vietnam, Tailandia…).[12]. La guerra libra/e-yuan sería parcialmente territorial porque los Estados Unidos y China serían inicialmente exclusivos entre sí: ningún e-yuan en los Estados Unidos y ninguna libra en China (no es sólo por una historia de contenido intelectual que China se cerró al GAFA). Pero, todavía en primera instancia, las zonas intermedias serán «libres» para utilizar ambas monedas en su comercio internacional además de su propia moneda, escritural, si creemos en Greenspan, localmente. Pero la expansión es el impulso natural de cualquier lógica de poder y dinero. Y las «zonas intermedias» pronto se verían aplastadas por la creciente demanda de «elegir bando». [1] Fuente: AISkills, 23/10/2019 [2] Fuente: BoxMining, 13/11/2019 [3] Fuente: Bloomberg, 12/08/2019 [4] Más fuerte que el Viernes Negro Americano, el Día de los Solteros Chinos. Fuente: The Telegraph, 11/11/2019 [5] Fuente: NewsMax, 12/11/2019 [6] Fuente: Forbes, 07/10/2019 [7] Fuente: etorox, 15/08/2019 [8] Fuente: Wired, 11/12/2019 [9] Fuente: Reuters, 03/11/2019 [10] Fuente: OECD, 2018 [11] Fuente: CNBC, 25/04/2019 [12] Fuente: Statista, 07/2019 |

|

FUENTE NUMERO 1 AISKILLS

The boss of Facebook has tried to respond to criticism and questions of US officials, who are concerned that its digital currency destabilizes the sovereignty of states. The World with AFP Posted today at 21h48 Time toReading 1 min. Mark Zuckerberg during his hearing in front of US officials, Wednesday, October 23. ERIN SCOTT / REUTERS The libra will wait. Asked by US elected members of the parliamentary committee on financial services, Facebook boss Mark Zuckerberg was open to the possibility of revising his digital money project if he failed to get all the green lights needed. “Clearly, we have not yet locked exactly how it will work”he admitted Wednesday, October 23, under the fire of criticism of elected officials. The CEO of the social media giant has answered many questions and accusations about his money project, which is expected to offer, from the current 2020, a new payment method outside the traditional banking channels, to buy goods or send money as easily as an instant message. Article reserved for our subscribersRead also Libra: “This electronic wallet has flaws on which Facebook does not provide any guarantee at this stage” “The goal of libra is first to build a global payment system, more than a currency”, he said. Such a system could be simply based on an existing currency, but would be much less ambitious than a new currency backed by a basket of currencies. Asked about the possibility of linking the libra only to the US dollar, Mark Zuckerberg replied that ” the community [de partenaires] was divided on this issue “. For if it would facilitate the creation of cryptocurrency from the point of view of regulators, it would be “May be less welcome in some places if it were 100% based on the dollar,” he warned. FUENTE NUMERO 2 BOXMINING What is DCEP Digital Currency DCEP (Digitial Currency Electronic Payment, DC/EP) is a national digital currency of the China built with Blockchain and Cryptographic technology. The currency is pegged 1:1 to the Chinese National Currency – the RenMinBi (RMB). The overall objective of the currency is to increase the circulation of the RMB and international reach – with eventual hopes that the RMB will the a global currency like the US Dollar. China has recently established an initiative to push forward Blockchain adoption, with the goal of beating competitors like Facebook Libra – a currency which Facebook CEO Mark Zuckerberg claims will become the next big FinTech innovation. China has made explicit that Facebook Libra poses a threat to the sovereignty of China, insisting that digital currencies should only be issued by governments and central banks. DCEP is the only legal digital currency in China DCEP is a currency created and sanctioned by the Chinese Government. It is not a 3rd party stable coin such as Tether’s cryptocurrency token “CNHT” which is also pegged to the RMB in a 1:1 ratio. DCEP is the only legal digital currency in China (cryptocurrencies such as Bitcoin are not legal tender in China). Huang Qifan (Chairman of the China International Economic Exchange Center) said they have been working on DCEP for five to six years now and is fully confident it can be introduced as the country’s financial system. It’s currently being rolled out, with the People’s Bank of China (PBoC) issuing the currency. Deployment and Distribution DCEP will initially be distributed to all commercial banks affiliated with the Chinese Central Bank such as ICBC and Agriculture Bank of China. The rollout of DCEP will be similar to that of physical yuan. The significance of DCEP is that it’s designed as a replacement of the Reserve Money (M0) system, cutting back the cost and friction of bank transfers. Huang pointed to outdated systems like SWIFT is both slow, inefficient and costly for inter-bank payment transactions. This initial deployment will serve as an official production test for the currency system, where the network and security will be validated. In the second phase, DCEP will be distributed to large fintech companies such as Tencent and Alibaba to be used in WeChat Pay and AliPay respectively. DCEP is a centralized, sovereign issued currency. It is not possible to mine DCEP or stake on the DCEP network. |

|

FUENTE NUMERO 3 BLOOMBERG

The People’s Bank of China is “close” to issuing its own cryptocurrency, according to a senior official. The bank’s researchers have been working intensively since last year to develop systems, and the cryptocurrency is “close to being out,” Mu Changchun, deputy director of the PBOC’s payments department, said at an event held by China Finance 40 Forum over the weekend in Yichun, Heilongjiang. He didn’t give specifics on the timing. Mu repeated the PBOC’s intention that the digital currency would replace M0, or cash in circulation, rather than M2, which would generate credit and impact monetary policy. The digital currency would also support the yuan’s circulation and internationalization, he said. China’s PBOC Considers Plan to Replace Cash and Sideline Bitcoin The remarks signal the PBOC is inching toward formally introducing a digital currency of its own after five years of research. Facebook Inc.’s push to create cryptocurrency Libra has caused concerns among global central banks, including the PBOC, which said the digital asset must be put under central bank oversight to prevent potential foreign exchange risks and protect the authority of monetary policy. “Libra must be seen as a foreign currency and be put under China’s framework of forex management,” Sun Tianqi, an official from China’s State Administration of Foreign Exchange, said at the forum. Unlike decentralized blockchain-based offerings, the PBOC’s currency is intended to give Beijing more control over its financial system. According to patents registered by the central bank, consumers and businesses would download a mobile wallet and swap their yuan for the digital money, which they could use to make and receive payments. Crucially, the PBOC could also track every time money changes hands. The central bank will “expedite the research of China’s legal digital tender” and monitor the trends of virtual currency development at overseas and at home, the PBOC said in a statement listing its work plan for the second half of 2019 released in early August. “It is without doubt that with the announcement of Libra, governments, regulators and central banks around the world have had to expedite their plans and approach to digital assets,” said Dave Chapman, executive director at BC Technology Group Ltd. They have to consider the possibility that non-government issued currencies could “dramatically” disrupt finance and payments, Chapman said. FUENTE NUMERO 4 irrelevante FUENTE NUMERO 5 irrelevante FUENTE NUMERO 6 FORBES Facebook’s Blockchain-Based Cryptocurrency Libra: Everything You Need To Know There will be a new cryptocurrency available in 2020—Libra. Although it is backed by several Silicon Valley and mega-companies that make up the Libra Association, Facebook is clearly the leader driving the currency’s adoption. Here’s everything you need to know. What is a cryptocurrency? Although there are variations of virtual currency called cryptocurrency, the one most people have heard about before is Bitcoin. They are all based on the concept of blockchain. A blockchain is a distributed computer file that can be read by people across many computers. There is not one entity with control over the file. Blockchains contain encoded information that can't be changed unless a user has a key that corresponds to the "block" in the chain they want to update. These changes get replicated across the chain. Blockchains are highly secure and publicly viewable. Cryptocurrency is a currency that uses a mathematical blockchain to track exchanges and value, rather than a central bank. About Libra Facebook announced Libra on June 18, 2019. A Swiss group called the Libra Association will govern Libra and currently includes 28 member companies, including Facebook, MasterCard, Visa, Lyft, Uber, and Spotify, and plans to have 100 companies on board in 2020 when Libra is expected to launch. Today In: Innovation According to the 26-page technical white paper released to describe how Libra will work, it will run on a blockchain. However, it's important to note; Libra diverges from a traditional blockchain in a couple of ways. 1. A traditional blockchain is decentralized. Libra is not decentralized in the way that Bitcoin is since Libra’s nodes (independent computers that process and verify a blockchain) will only be run from the servers of Libra Association’s 28 current members. In response to critics who question the fact that Libra isn’t fully decentralized, Facebook said that Libra can’t be fully decentralized if it’s to create a “global financial infrastructure.” The goal is to have Libra be capable of handling 1,000 transactions per second; Bitcoin can only process seven transactions per second, but Visa's payment network can support 24,000 a second. 2. Libra is also being designed as a “stablecoin.” The value of Libra units in circulation will be tied to assets made up of various currencies stored by the Libra Association. This is to minimize the traditional volatility of cryptocurrency. In a letter Facebook sent to Fabio De Masi, a German politician, Libra will be backed by the U.S. dollar (50 percent), euro (18 percent), Japanese yen (14 percent), British pound (11 percent) and Singapore dollar (7 percent). Interestingly, the currency of the world's second-largest economy, the Chinese yuan, is absent. There are pros and cons to the yuan not being included, but some believe its omission could help assuage concerns of American regulators. How world leaders are reacting to Libra Since Facebook announced Libra, it’s faced criticism. Regulators and policymakers around the world are concerned about Libra’s impact on financial stability. The EU launched an investigation of the Libra Association on antitrust issues. In the United States, lawmakers are pressing Facebook for a moratorium on the project until all issues can be analyzed and understood. Due to this and other concerns, it’s being reported that some of the original supporters of Libra are backing out. In France, Bruno Le Maire, the French Economy, and Finance Minister stated that they could not "authorize the development of Libra on European soil” due to the threat to monetary sovereignty. Some world financial leaders have expressed concern that Libra threatens the financial stability of nations. Facebook refutes these claims while pointing to the “stablecoin” aspect of Libra and the reserve of currencies that backs it up. A Libra spokesperson told The Independent: "We welcome this scrutiny and have deliberately designed a long launch runway to have these conversations, educate stakeholders, and incorporate their feedback in our design." There’s certainly a revolution underway in payment technology from China’s Alipay to Facebook’s Libra. Since finance is a critical part of the world’s infrastructure and a crisis in one market can ripple across the world, it behooves governments and regulators to critically assess new technology that’s untethered from traditional control systems. Not only does a new global financial system need to be safeguarded from breaches and transparent to officials, but it also must not succumb to whims that would only benefit a few. That’s why there are significant questions that need to be answered to fully understand the implications prior to the launch of Libra in 2020. |

|

FUENTE NUMERO 7 ETOROX

FUENTE NUMERO 8 WIRED China is Pushing Toward Global Blockchain Dominance In a speech late last month, Chinese leader Xi Jinping declared blockchain “an important breakthrough,” and promised that China would “seize the opportunity.” He detailed the ways the Chinese government would support blockchain research, development, and standardization. The significance shouldn’t be underestimated. Xi is the first major world leader to issue such a strong endorsement of the much-hyped, and much-maligned, distributed ledger technology. His words are already having a major impact. Like the internet, blockchain is a powerful tool that can nurture freedom and competitive innovation, or reinforce concentrations of power. Those who favor the former vision cannot take it for granted. The United States’ leaders are doing just that. Xi’s speech unleashed a cascade of activity. Propaganda organs such as People’s Daily and Study the Great Nation, the mobile app that teaches “Xi Jinping thought” to Communist Party members, immediately launched a wave of educational content. Cities marshaled funds for subsidy programs. Censors declared that calling blockchain a scam on social media was henceforth forbidden. Chinese investors rushed to buy any stock vaguely associated with blockchain, reminiscent of the mini-bubbles in Long Island Blockchain and Kodak during the initial coin offering frenzy of 2017. The price of bitcoin shot up 12 percent in the day following the speech. China’s already significant blockchain activity will be supercharged. Over 500 blockchain projects, from many of China’s most powerful companies, have already registered since last year with China’s Cyberspace Administration. The People’s Bank of China (PBOC) is stepping up efforts to launch a Digital Currency Electronic Payment System (DCEP), which could replace cash with a blockchain-based solution. It would make China the first major economy to adopt a native digital currency. China could then use DCEP to manage funding for its Belt and Road program of overseas infrastructure investments, extending its monetary sphere of influence. Across the Pacific, the picture is quite different. Two days before Xi’s remarks, Mark Zuckerberg faced a hail of criticism on Capitol Hill for Facebook’s proposed Libra digital currency. Several partners in the venture had already pulled out after threatening letters from Democratic senators and sharp criticism from Federal Reserve Board chair Jerome Powell. And the skepticism isn’t limited to Libra. This summer, President Trump declared himself “not a fan” of cryptocurrencies, which he described as “based on thin air” and likely to “facilitate unlawful behavior.” The Securities and Exchange Commission is stepping up enforcement actions in the area. In October it blocked messaging platform Telegram from issuing $1.7 billion in cryptocurrency tokens over compliance with securities laws. Zuckerberg and cryptocurrency enthusiasts chastise the US for resisting business innovation that China is embracing. They argue that unless cryptocurrency creators have free rein to deploy their systems at mass scale, Chinese alternatives will prevail. This analysis is over-simplistic. Regulators are right to be concerned about the impacts Libra and initial coin offerings may have on monetary policy and global financial stability. Cryptocurrencies can indeed be used for money laundering, terrorist financing, fraud, and other illegal conduct. Giving platforms like Facebook too much power over payment systems could further cement their dominance and erode privacy protections. The real danger is that China recognizes blockchain as a strategic technological innovation, which the US government is ignoring. China, the world’s biggest censor, has no love for “censorship-resistant” permissionless cryptocurrencies. It understands the threat that stateless money poses to capital controls and other mechanisms of power over a national economy, as well as the prevalence of illegal activity. Initial coin offerings such as Telegram’s are banned in China, as are exchanges to trade cryptocurrencies for yuan. The PBOC’s digital currency is far from a vote of confidence in Bitcoin. It is designed to supplant Bitcoin and its brethren with a system controlled by government authorities. Xi’s speech was entirely about blockchain, not cryptocurrencies. China appreciates that the global financial system is approaching a technological transition. Record-keeping systems based on database technologies originally developed in the 1960s and confined by national borders cannot keep pace with a globalized, automated, increasingly AI-driven world. All of finance is turning into fintech. This shift demands new infrastructures and payment instruments. Outgoing Bank of England governor Mark Carney recently called for a synthetic hegemonic currency that, like Libra, would use a basket of national currencies for backing. Last year, then-IMF managing director Christine Lagarde described a “historic turning point” toward digital currencies. Here in the US, the Fed has been working for years to replace its Fedwire platform with a faster digital payments system. FUENTE NUMERO 9 REUTERS BANGKOK (Reuters) - Thailand said on Sunday that Southeast Asian nations are committed to signing a pact by February 2020 on forging what could become the world’s largest trade bloc, even after new demands by India dealt a blow to the process backed by China. Going into this weekend’s summit of the Association of Southeast Asian Nations (ASEAN) in Bangkok there had been hopes of finalizing negotiations this year on the 16-nation Regional Comprehensive Economic Partnership (RCEP). But the ASEAN chairman’s final statement released on Sunday night said the 10-nation grouping welcomed a “commitment to sign the RCEP Agreement in 2020”. “This will significantly contribute to an open, inclusive and rules-based international trading system and expansion of value chains.” New impetus to reach agreement has come from the U.S.-China trade war, which has helped knock regional economic growth to its lowest in five years. “The early conclusion of RCEP negotiations will lay the foundation for East Asia’s economic integration,” said a statement from China’s foreign ministry after Premier Li Keqiang met Southeast Asian leaders. But Indian Prime Minister Narendra Modi did not even mention the RCEP talks in opening remarks at a meeting with Southeast Asian leaders and instead spoke only of reviewing the existing trade agreement between ASEAN and India. Nor did Modi mention the trade bloc, whose 16 countries would account for a third of global gross domestic product and nearly half the world’s population, in Twitter posts after meeting Thai and Indonesian leaders. An Indian foreign ministry official later told a media briefing “Let’s take all the RCEP questions tomorrow.” Southeast Asian countries had hoped at least a provisional agreement could be announced on Monday. But India has been worried about a potential flood of Chinese imports. A person with knowledge of New Delhi’s negotiations said new demands were made last week “which are difficult to meet.” TRADE WAR IMPACT Negotiators were meeting into the evening on Sunday to try to come to an agreement, Thai government spokeswoman Narumon Pinyosinwat told reporters on Sunday. “We don’t have a conclusion yet. Once there is one, it would be announced,” she said. “Commerce ministers are still discussing outstanding issues. The signing is expected around February next year.” Thai Prime Minister Prayuth Chan-ocha told the formal opening of the ASEAN summit on Sunday that the 16 nations in the potential trade bloc ought to come to agreement this year to stimulate economic growth, trade and investment. He highlighted the risks of “trade frictions” and “geo strategic competition” in the region. Some countries have raised the possibility of moving ahead without India on forming a bloc that also included Japan, South Korea, Australia and New Zealand. But Thai commerce minister Jurin Laksanawisit told Reuters on Sunday that India had not pulled out. Another advantage for Southeast Asian countries from having relative heavyweight India in the trade pact would be less domination by China. Longstanding rivals China and India, which fought a border war in 1962, have clashed verbally in recent days over India’s decision to formally revoke the constitutional autonomy of the disputed Muslim majority state of Kashmir. The U.S. decision to send a lower level delegation to the summits this year has raised regional concerns that it can no longer be relied on as a counterweight to China’s increasing regional might. |

|

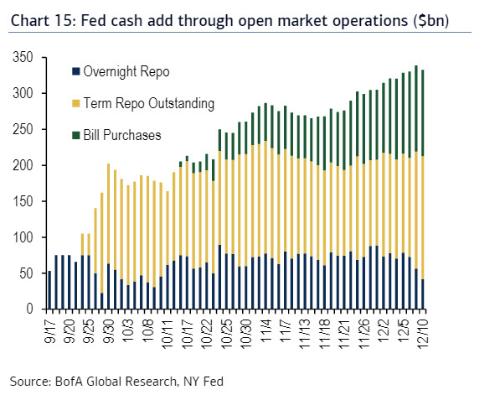

A ver si se ve bien- Lo pondre grandote. Me he pasao de cantidad. No son mas de 400 mil millones sino algo mas de 300 mil millones en total lo que desde mediados de Septiembre ha estado inyactando la Reserva Federal en su sistema bancario (de hecho, para las entidades que operan alla, pues el Deutsche Bank estaba en las quinielas de la que se suponia que era una entidad en graves problemas de liquidez, y no es el, sino.............J.P. Morgan

Si esto no es una QE, la cuarta, que venga San Chopanza y dictamine |

Re: FINANZAS Y AÑO 2020. SE AVECINAN CAMBIOS

|

En respuesta a este mensaje publicado por hector77

CONTENIDOS ELIMINADOS

El autor ha borrado este mensaje.

|

|

En respuesta a este mensaje publicado por hector77

Se te echaba de menos, Hector.

Interesante aportación. Por mi parte, sólo puedo aportar de forma verificable esto: https://www.armstrongeconomics.com/products_services/products/why-the-fed-stopped-lowering-short-term-rates/ Si Martin Armstrong está en lo cierto, estamos ante la madre de todas las crisis financieras. Tiendo a pensar lo mismo, pero no dice nada para evitar que le acusen de causar la crisis (¿y para hacer caja?). Personalmente, y por información interna que no puedo publicar (o sea, para vosotros, nada creíble), la cosa está mal, muy mal, y yendo a peor. Aparentemente, calma chicha, con algunos truenos y relámpagos a lo lejos, que no está claro que se acerquen, aunque algunos estamos convencidos que vienen. Que esto sea en cámara lenta es todavía peor, ya que habitualmente significa que la cosa será más profunda y difícil de lo previsto, y que no habrá marcha atrás. Muchas cosas que ahora damos por sentadas, simplemente desaparecerán. Pero bueno, lo dicho, no tengo credibilidad en esto. Peor aún, crisis financiera/económica que estallará en lo político/social. Nada que ver con energía ni con climatología. La culpa de todo será financiera/económica. Que detrás esté una TRE demasiado baja y decreciente, no importará a nadie. Demasiado difícil de demostrar y de entender. La corrupción será señalada como culpable. Que detrás de la 'receta' del cambio climático haya eléctricas (el 'oligopoly'), y otros intereses económicos también será parte de la causa pública. Y en ambos casos, tendrán razón. Nada, simples opiniones del siguiente eslabón en la cadena trófica. |

|

Gracias por vuestras palabras. Factores "externos" me han tenido algo alejado de vosotros pero de vez en cuenta echaba un ojo sobre todo a los articulos de Antonio.

Una cosa: el vinculo que muestras, Beam, no tengo manera de ir al cotenido que ofrece Armstrong. Supongo que es pagando. He leido algun rumor (sin confirmar) que la crisis de los Repos se esta extendiendo. Ahora no se si en Keiser Report. Me tienes intrigado a mi (y seguro que tambien a todo el personal) con la informacion que tienes acerca de que la cosa va peor. ¿Es en relacion con la industria automovilistica? Supongo que si, pero entiendo que no puedas dar muchos detalles y que ya has dado unos cuantos en el tiempo y quieras conservar el anonimato. |

Re: FINANZAS Y AÑO 2000. SE AVECINAN CAMBIOS

No que va. Al contrario. https://www.zerohedge.com/markets/repo-crisis-fades-away-first-time-turn-repo-not-oversubscribed Yo creo que era un esquema para ganar dinero a costa de la Fed y forzar una intervención que sostenga los mercados durante la presente debilidad económica. Eso es muy preocupante pero en otro orden. Que haya agentes económicos capaces de forzar al banco central de última reserva del mundo a actuar como ellos quieren es terriblemente preocupante e indica que la cosa está cada vez más descontrolada.

Blog: Game Over?

|

|

Bueno, si nos fijamos especificamente en el mercado de repos norteamericano hay un articulo extenso, tecnico, pero que puede ayudarnos a comprender algo de lo que esta pasando.

Recomiendo la extension del Traductor de Google para traducir la pagina. El Banco Internacional de Pagos ya se ha posicionado al respecto y parece que si que hay razones objetivas, estructurales, de peso, para seguir con este influjo de fondos, que si no he leido mal un par de veces por ahi se extendera durante el mes de enero a 500 mil millones de dolares mas. Una burrada, vamos. Por eso en el articulo habla de una "full QE" a la vuelta de la esquina, porque van a tener que hacerlo. Un esquema ponzi no se puede desmontar, solo seguir alimentandolo mas y mas..... https://seekingalpha.com/article/4312840-repo-abundant-reserves-regime-is-broken |

|

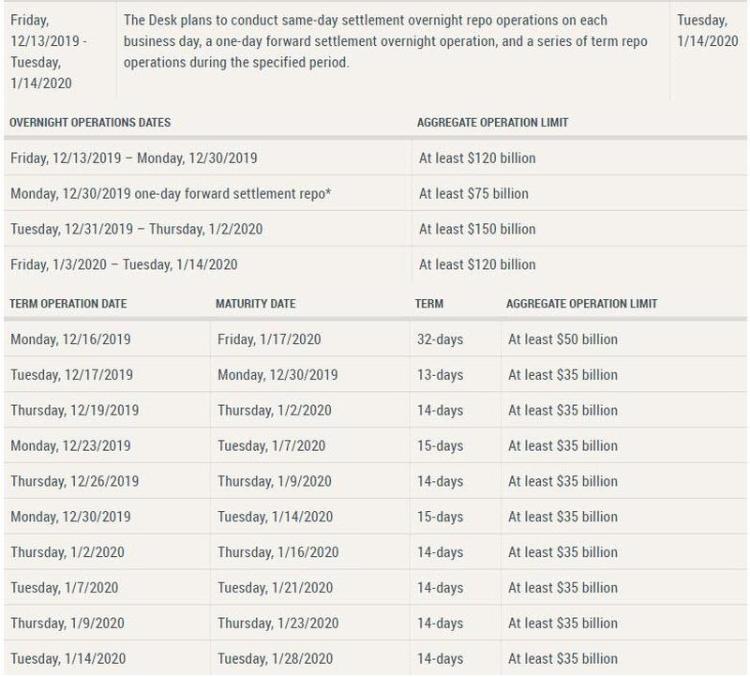

He encontrado el calendario de la FED pero en este reporte termina en el 14 de Enero

Espero se vea bien

|

|

El asunto de exceso de deuda (mega-hiper-exceso) y falta de liquidez de dolares por el mundo mundial tiene sus consecuencias mas alla de Yankeelandia:

The New York Times: las empresas chinas se quedan sin dinero para pagar sus deudas La semana pasada, la empresa Peking University Founder Group se saltó el pago de bonos por un valor de 284 millones de dólares, hecho que no pasó desapercibido en China, dado que la mayor parte de sus accionistas son representantes del brazo financiero de uno de las mejores y más antiguas universidades del país asiático. Este no ha sido un caso aislado. La compañía comercial Tewoo Group ha sido la primera en saltarse el pago a los inversionistas extranjeros en dos décadas. Controlada por el Gobierno de la ciudad china de Tianjin, esta compañía está en apuros por haber acumulado una deuda de 1.250 millones de dólares. Se avecina un tsunami de vencimientos La tendencia a endeudarse cada vez más surgió en China durante la época de expansión económica producida luego de la crisis del 2008. En aquel entonces, los acreedores mundiales estaban listos para echarles mano en busca de grandes retornos. Ahora, mientras los plazos de pago van venciendo, los empresarios chinos no logran encontrar recursos para pagar sus deudas debido a la peor desaceleración económica registrada en casi tres décadas. Este año, las corporaciones chinas no han pagado a sus acreedores casi 20.000 billones de dólares. Si bien este monto parece ser bastante pequeño en términos del tamaño de la economía china, las deudas no han parado de crecer. Y sigue en https://mundo.sputniknews.com/economia/201912141089645679-empresas-chinas-se-quedan-sin-dinero-para-pagar-deudas/ Va a ser un 2020 la mar de sobresaltado..... |

Re: FINANZAS Y AÑO 2000. SE AVECINAN CAMBIOS

Está claro que el sistema puede saltar en el 2020, pero también puede aguantar con parches hasta 2025, 2030, 2035. Por lo que aunque el colapso sea inevitable, lo más probable es que no sea precisamente en 2020. Y eso hace un mundo de diferencia. Por mi que mal que bien aguante hasta que me muera de viejecito, aunque lo dudo.

Blog: Game Over?

|

|

En respuesta a este mensaje publicado por hector77

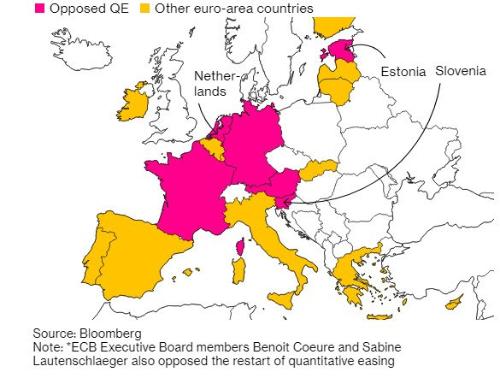

Y una vez que he hablado "mal" de Yankeelandia y China, le toca el turno a Europa:

En este mapa se muestra la division entre los paises partidarios de mas expansion cuantitativa (hasta el infinito, si fuera necesario) y los mas....¿calvinistas? Nuevamente, siento si causo alguna disrupcion en el ancho del foro mostrado por el navegador como consecuencia de mi manejo de las imagenes

|

|

Gracias por tu excelente aportación. Se aprecian artículos de calidad.

El sistema capitalista actual es en un 75 % especulativo y tarde o temprano se reseteará. es inevitable, en tanto diversificar .

|

Re: FINANZAS Y AÑO 2000. SE AVECINAN CAMBIOS

|

Todos los huevos en la misma cesta?

La noche es oscura y alberga horrores.

|

«

Volver a Economía

|

1 vista|%1 vistas

| Free forum by Nabble | Edit this page |